Trade of the Month MAY 2023

MARCH 2023 FAST 50 First Month Live Trading Signals Results

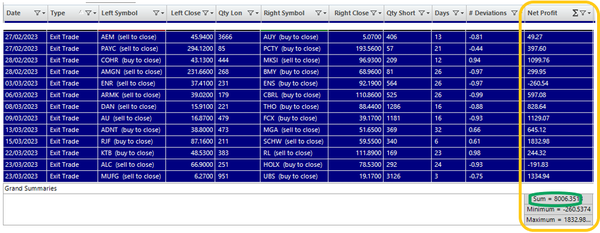

(EOD signals, available to trade, assumed $120,000 account equity*)

Our latest FAST 50 U.S. Equity Pairs Vintage were released on 26 Feb 2023.

If you had replicated all open trades on the Monday market open after launch, and then taken all of the UNFILTERED trading signals called by these pairs for 4 weeks up to 25 March, you would have had:

11 Winners out of 13 closed trades

85% Win Rate

3.4x Reward/Risk

$8,006 profit on the closed trades so far…

… Read More →Pair Trade Money Management

For any good trading system, money management is a critical component to overlay. We refer to position sizing and trade management as “Money Management”.

April’s Trade of the Month barked and bit – like a badly behaved dog to be fair. However – if you are using prudent pair trade money management techniques – you can force a scary Cerberus back into his cage and turn this losing trade into a winner! Watch as professional pair trader Pedro Alonso takes you through what you need to know in this great VIDEO HERE:

Learn Pair Trade Money Management Techniques Using Our FAST 50 Cointegrated U.S. … Read More →

Learn Pair Trade Money Management Techniques Using Our FAST 50 Cointegrated U.S. … Read More →

Best Stock Pairs to Trade? PTF PRO FAST 50!

Bank stock crashes and crazy market volatility got you down???

Don´t let them! Instead, use the market’s volatility to squeeze profits from stock pair trading! And where do you find the best stock pairs to trade? Look no further than our FAST 50!

Watch our video as professional pair trader Pedro takes you through a killer pair trade on this financial pair in March. Why he loved the trade and the handsome reward/risk profile:

How to Find the Best Stock Pairs to Trade

How to Find the Best Stock Pairs to Trade

When you subscribe to PairTrade Finder® PRO,

… Read More →Stock Pair Trading Signals: Trade of the Month Feb 2023

Looking for a “side hustle” that can be learned relatively easily and can generate a recurring income?

How about stock pair trading with our award-winning software, PairTrade Finder® PRO? Next, add in the live stock pair trading signals generated from our pre-loaded FAST 50 U.S. Stock Pairs! Watch our VIDEO:

Subscribe for High-Probability Stock Pair Trading Signals Today! www.pairtradefinder.com

Leverage Our Expertise: Receive Stock Pair Trading Signals Using PairTrade Finder’s FAST 50 Cointegrated U.S. … Read More →

Subscribe for High-Probability Stock Pair Trading Signals Today! www.pairtradefinder.com

Leverage Our Expertise: Receive Stock Pair Trading Signals Using PairTrade Finder’s FAST 50 Cointegrated U.S. … Read More →

Stock Pair Trading with the Copula Method vs. the Cointegration Method – A Layperson´s Explanation

Stock pair trading is a popular strategy among algorithmic traders. It involves identifying two stocks that have a historical relationship and trading the pair long/short based on the deviation from this historical relationship. The idea is to buy long the underperformer in the pair and sell short the overperformer once their relative performances have diverged. The trader profits if this relative performance re-converges. In this blog post, we will discuss two statistical approaches used in stock pair trading: the copula method and the cointegration method.

The Copula MethodThe copula method involves modeling the marginal distributions of the two stocks separately and then using a copula function to model the dependence structure between them.

… Read More →Automated Pair Trading Signals

(based on 5:1 CFD margin)

Learn a proven trading strategy that is viable in all market conditions and is backed up by decades of academic research and real-world application…stock pair trading! WATCH OUR VIDEO of pro pair trader Pedro Alonso as he takes you through this month’s selected stock pair trade analysis. This live signal is from the automated pair trading signals of our November FAST 50 U.S. Equities Pairs:

Don´t Have Time to Backtest and Filter? … Read More →

Don´t Have Time to Backtest and Filter? … Read More →

Pair Trade of The Month: November 2022

The Best Stock Pairs to Trade www.pairtradefinder.com

Pair Trading for Income?

The Best Stock Pairs to Trade www.pairtradefinder.com

Pair Trading for Income?

Looking for a part-time occupation that can be learned relatively easily and can generate a recurring income?

That can take as little as 1 hour/day or even less?

That uses a share trading system that has been shown to deliver consistent profitability over many decades and in all stock market conditions?

Look no further than stock pair trading with our award-winning software,

… Read More →Scaling-In to Pair Trades: Turbo-Charge Returns with Layers on Low Volatility Stock Pairs

($10,000/leg, Double Layer Entry, 5:1 CFD Margin)

Many of you know that our award-winning pair trading software, PairTrade Finder® PRO, gives you the ability to program and execute multiple layered entries (scaling-in to a pair trade).

Watch our video taking you though our October Trade of the Month, where pro pair trader Pedro Alonso demonstrates scaling-in to a pair trade:

How Do I Learn Scaling-In to a Pair Trade?

How Do I Learn Scaling-In to a Pair Trade?

We have produced a tutorial on scaling-in and it forms part our acclaimed Pair Trading Video Course.

… Read More →Stock Pair Trade of the Month SEPT 2022

September sees us visit a new SLOW 60 U.S. Equities Pair for a great stock pair trade.

Asbury Automotive Group (NYSE:ABG) vs. Borg Warner (NYSE:BWA). These auto parts suppliers set up an infrequently available pair trade that delivered the goods quickly and efficiently.

$353 in 8 days, with no drawdown. ($5k/leg, 5:1 CFD leverage)

We wish they were all so smooth…

Watch our video as pro stock pair trade master Pedro Alonso Calvo shows you how this trade setup ticked (almost) all the boxes and was a slam dunk entry:

High-Probability Trading Signals Straight to Your Inbox www.pairtradefinder.com

Stock Pair Trade for Income Using PairTrade Finder’s SLOW 60 Cointegrated U.S. … Read More →

High-Probability Trading Signals Straight to Your Inbox www.pairtradefinder.com

Stock Pair Trade for Income Using PairTrade Finder’s SLOW 60 Cointegrated U.S. … Read More →