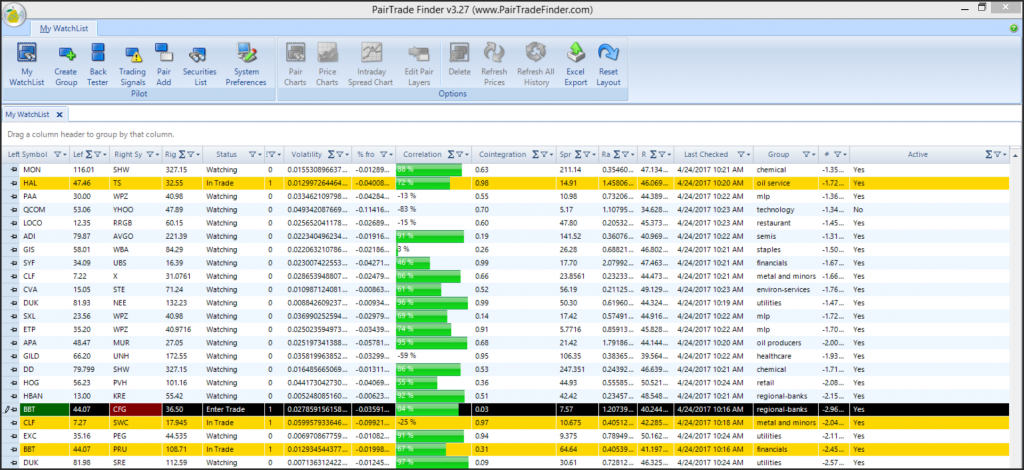

The Pairtrade Finder analytic generated a signal to purchase BB&T Corp and Sell/short Citizens Financial Corp. Both companies are in the financial space. Both stocks were buoyed following better than expected earnings, although the CFG was definitely a larger surprize. BB&T was upgraded and should recoup some of its recent losses versus CFG. Both companies released their earning during the week ending the 21st. The watchlist shows the levels to enter the trade, as the stretch reached 2.7 standard deviations below the 100-day moving average.

The backtest of the two stocks shows that over the past 3-years 4-signals were generated with a stretch of 2.7 standard deviations for an entry criteria, and a take profit or stop loss when the ratio (the price of CLF / SWC) reverted back to 1-standard deviation below the 100-day moving average.

The results were extremely impressive. The pair has a winning percentage of 100%. The profit per trade was approximately $450. The overall profit on the strategy over the 3-year period is $1,801, and the average correlation of the returns of the two shares is approximately 86%.

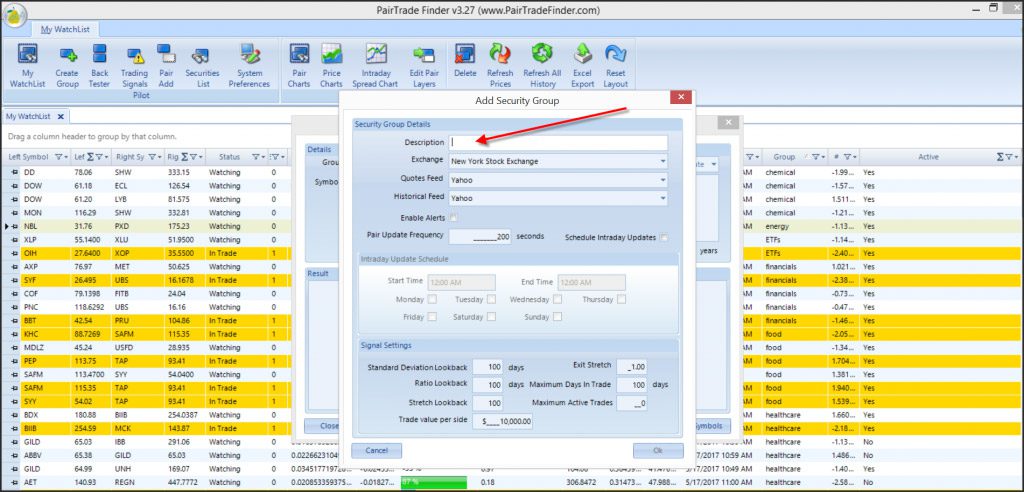

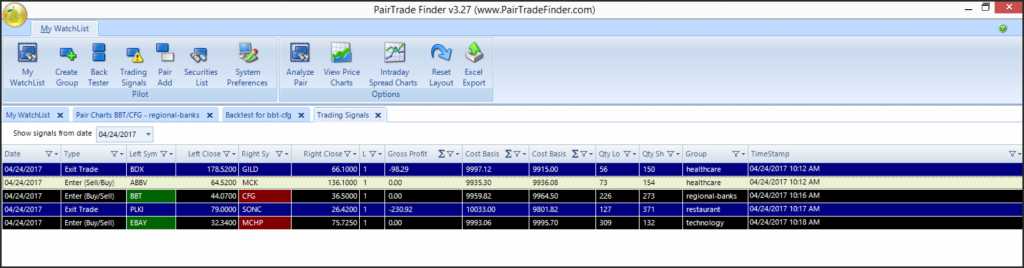

The trading signal section will describe the number of shares that need to be transacted if you use $10K on each side of the trade. You would need to purchase 226 shares of BBT at approximately $44.07 and short sell 371 shares of CFG at approximately $36.50. The ratio is approximately 1.23.

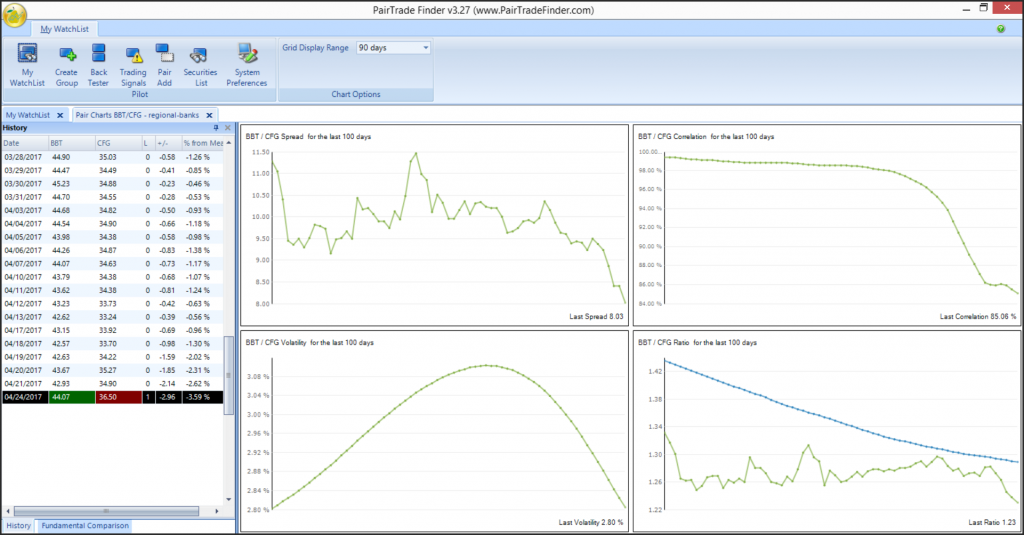

The chart of the pair shows that the ratio (lower right) tumbled to the low end of the distribution, which moved in tandem with the spread.

Contact us to start your 30-day free trial of Pairtrade Finder software, the perfect software tool designed to help you easily and quickly find high probability securities pairs to trade.