Tip #1 – Determine Why the Trade Signals for a Pair Trade Were Generated

So things are going well in your quest become a profitable equity pairs trader. As a result of following our 3-Hour, 11-Lecture Pair Trading Video Course, you have:

- Installed Pairtrade Finder v3.27 on your PC and ensured you have a clean internet connection to access Yahoo! Finance data and keep your My Watchlist pairs updated both EOD and intraday;

- Created groups of equities that are in the same or similar industries and sectors, have market capitalizations of at least $1 billion, and have a daily traded share value of at least $5 million. You can use our pre-loaded Excel sheets for this task, and copy and paste the tickers for each pre-filtered industry grouping into the Create Group entry screen;

- Generated the results of your backtests using your preferred parameters (we use an Entry stretch of 2.7 sd and an Exit stretch of 1.0 sd and always backtest over three years or more, looking for at least 8-10 trades in the pair history, and initially use only one Entry Layer);

- Screened the backtest results by your preferred parameters (we like to see at least $500 avg profit per trade using $10,000 per leg, at least 80% winning trades, and any largest losing trade that is no more than 50% of the avg winning trade);

- Saved the resulting pairs to My Watchlist so that they can now be updated both EOD and intraday to generate Trading Signals;

- Configured your email address into Pairtrade Finder to allow you to receive Trading Signals by Email if you desire.

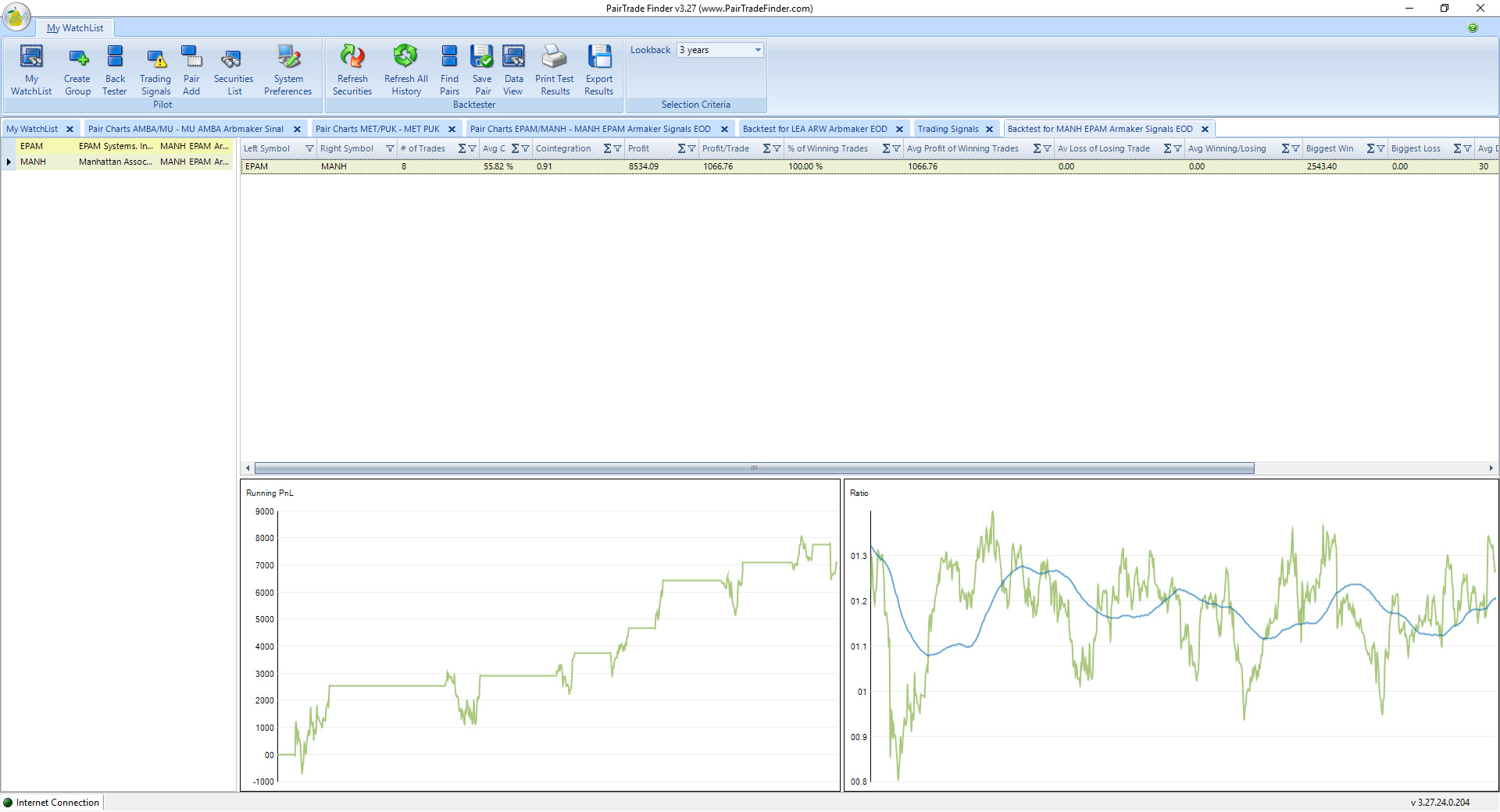

Below is a sample backtest from a good-looking pair EPAM/MANH (EPAM Systems, Inc. and Manhattan Associates, Inc.):

So now the wait begins…with the 2.7 sd Entry Stretch and 1.0 sd Exit Stretch, good pairs may only generate 2-3 entry signals per year. Therefore it pays to have My Watchlist populated with as many promising pairs as possible to allow you to maintain a diversified portfolio of trades at any one time with prudent position-sizing, stop-losses and diversification.

We might suggest as a rule of thumb that a prudent pair trader will have no more than 10% of their account equity in any one pair or individual stock, no more than 20% of their account equity in any one industry, a prudent stop-loss policy for any pair that really breaks down and a time-based stop for any pair that just doesn’t revert to the mean over time. So you will likely need 50 pairs or more on My Watchlist to maintain a portfolio of 8-10 pre-qualified pair trades open at any one time.

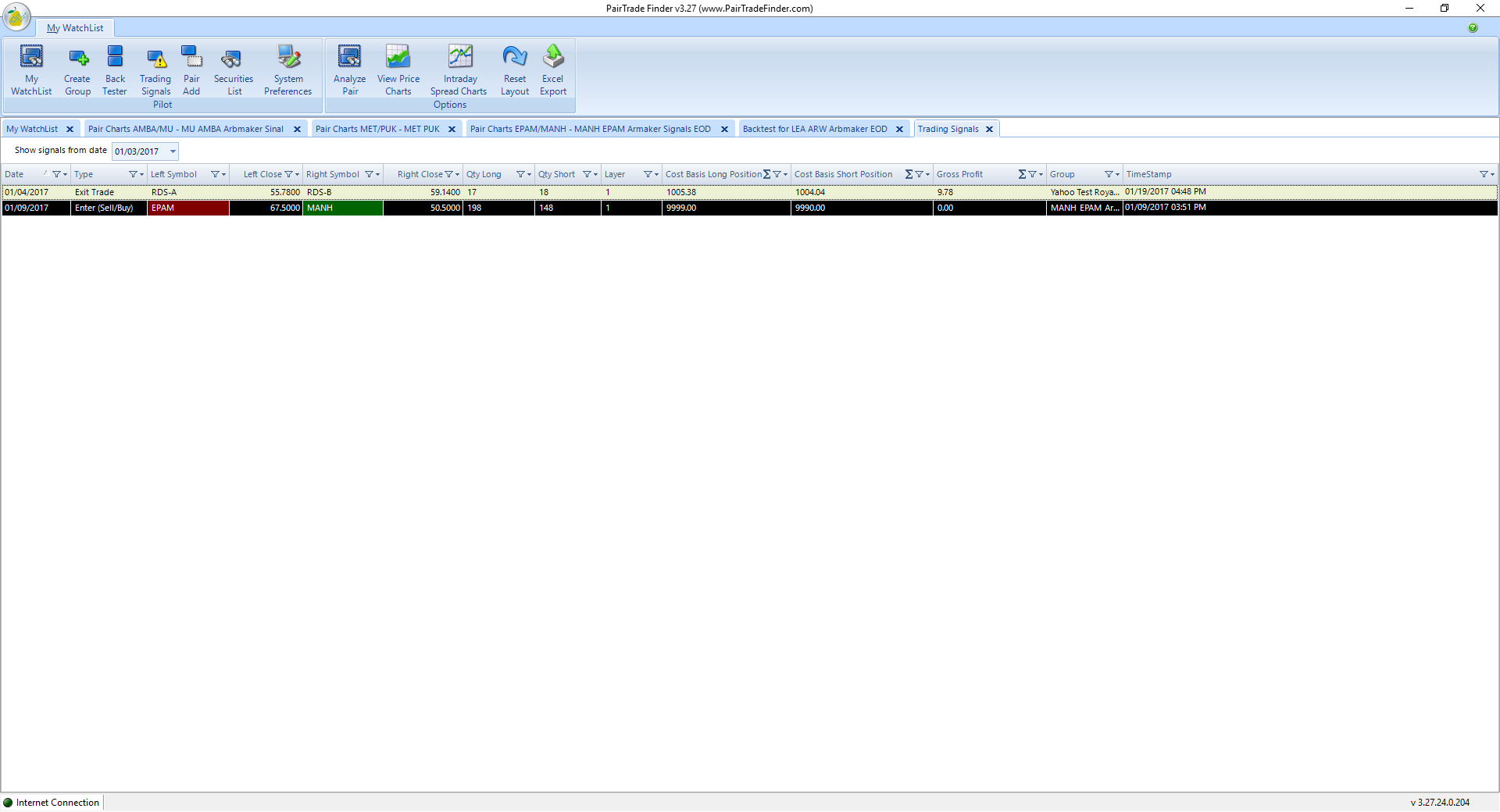

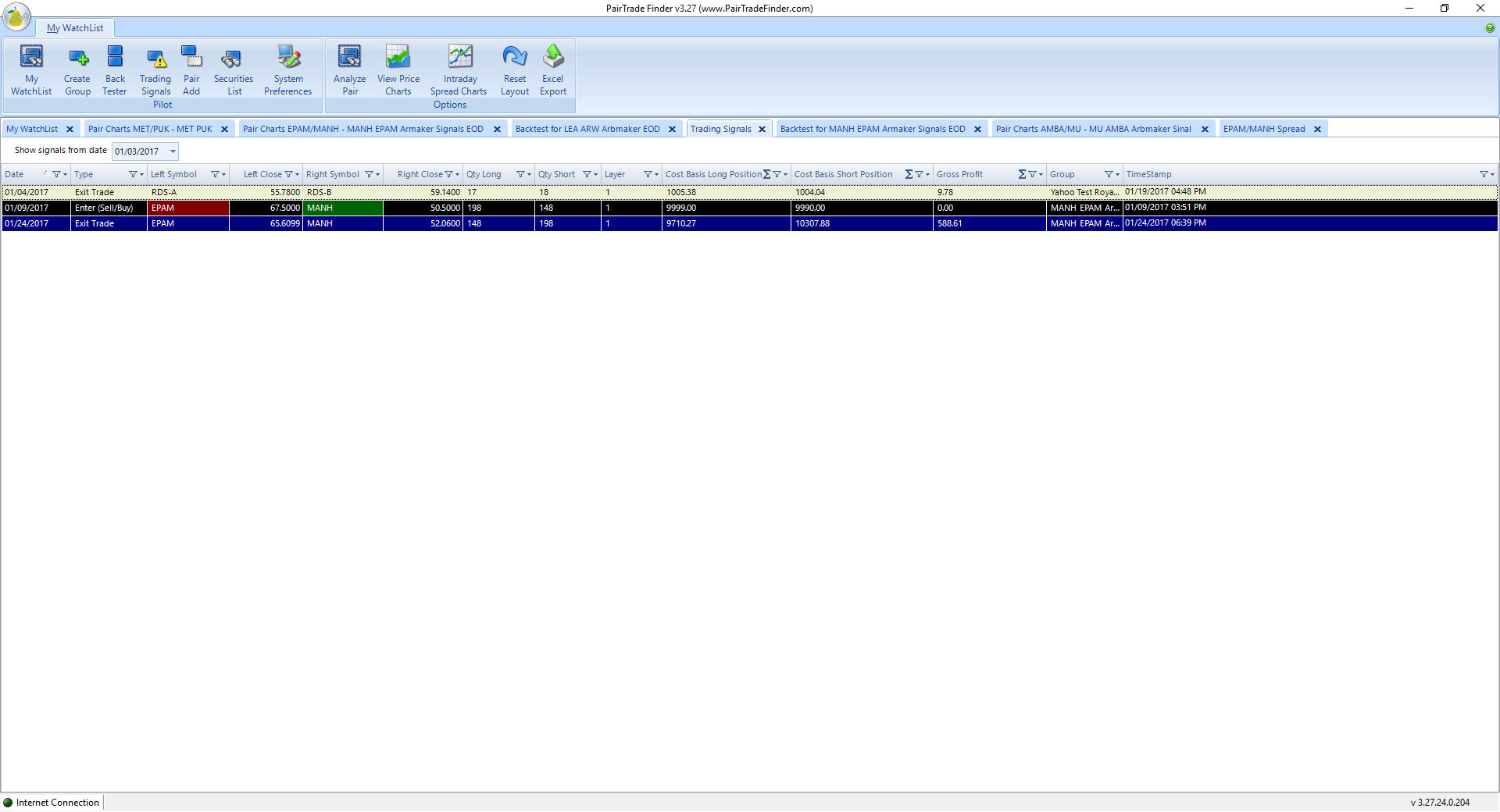

Then it happens – beep! A trade entry is called on one of your My Watchlist pairs. See the screenshot below:

A trade signal to Short 148 shares of EPAM at $67.50 and go Long 198 shares of MANH at $50.50 has been called. Do you immediately jump onto your broker platform and race to enter these trades? Not yet! (NB : with our upcoming Pairtrade Finder Pro v1.0 you can greybox trade these by sending the signal direct to your Interactive Brokers’ Trader Workstation as Limit Orders).

A prudent Pair Trader will follow all of our Trading Tips to pre-qualify and determine his parameters for trading the pair.

Here we cover our simplest, Trading Tip #1 – Determine Why the Signals for a Pair Trade Were Generated.

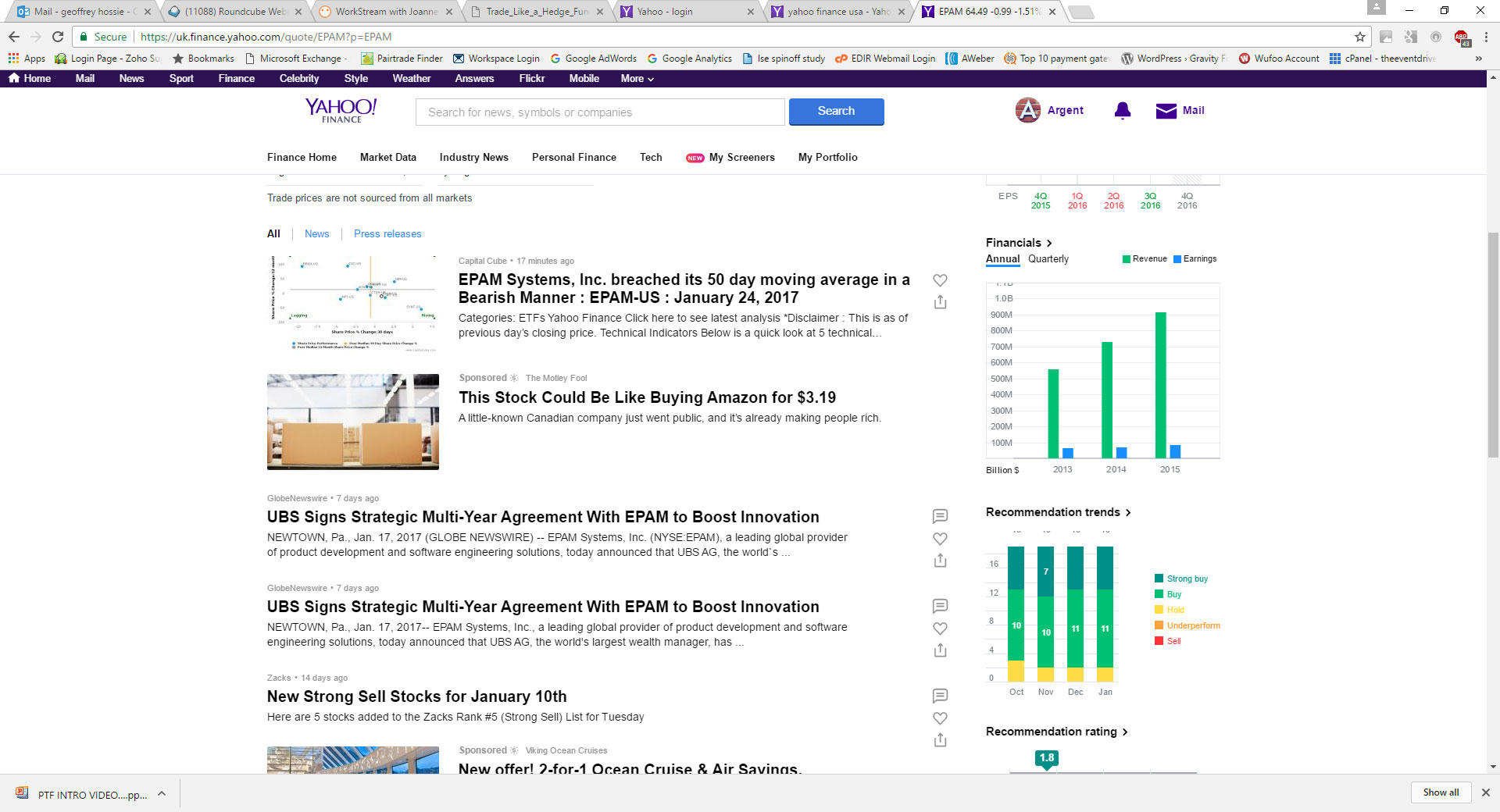

For example, was there a news release for one of the stocks in the pair related to earnings, dividends or some other announcement that you would expect to have an impact on the company’s valuation? Ideally, no news at all has been released recently or expected to be released soon (eg. the upcoming Earnings and Corporate Actions Calendar is clear) when a signal has been generated. In other words, you want to confirm that there has not been and there isn’t a logical reason why the two correlated stocks have diverged from each other. In its simplest form, we can go to the Yahoo! Finance Newsfeed for each ticker and review the headlines:

EPAM

Nothing on EPAM around 9 January 2017 in News and Press Releases…

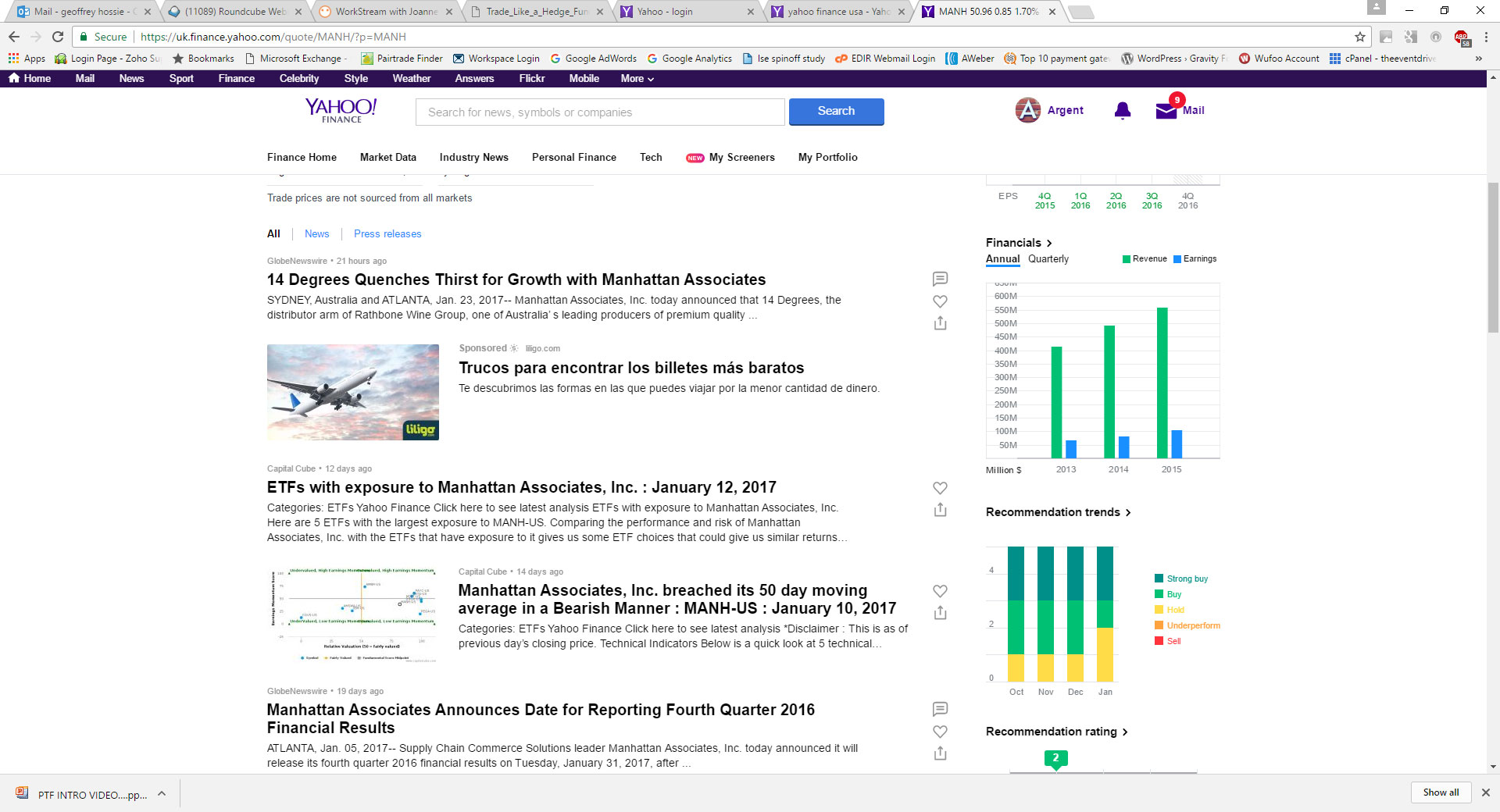

MANH

Nothing on MANH around 9 January 2017 either, though the Company did announce on 5 January that its Q4 Earnings will be released on 31 January 2017 after the close. The proximity of this earnings release is probably a sufficient reason to avoid the trade – earnings being released by one or both companies can potentially cause large and persistent relative share price moves. It is best to ensure that both legs of the pair have an Events Calendar that is clear for the next 30 days. Accordingly, a prudent Pair Trader would likely reject this Trading Signal and wait for a better one. However, given the very clean backtest results for this pair over the last three years…one might still proceed and move on to Tip #2…stay tuned!

Geoffrey Hossie

PS: If one did take the trade, here is how it worked out. $ 588.61 Gross Profit in 15 days: