PairTrade Finder® Ultimate Alpha 3.0 (PTF UA3) introduces an indispensable feature for sophisticated traders: the Relative Strength Index (RSI) filter. We give the astute trader an advanced compass in the sea of market volatility. Our video below has everything you need to use an RSI filter in pair trading:

How Does It Work?

Developed by the legendary Jay Wells Wilder in 1978, the RSI is a momentum oscillator that measures the speed and change of price movements, oscillating between zero and one hundred. Traditionally, a stock is considered overbought when RSI is above 70 and oversold when it’s below 30. PTF UA3 allows traders to adjust these thresholds, enhancing the precision of identifying optimal entry points for pair trades.

The power of the RSI filter within PTF UA3 lies in its ability to pinpoint when a pair is excessively deviated from its mean—essentially, determining the perfect moment to enter a trade for a mean reversion. By filtering out signals that do not meet extreme RSI criteria, traders can avoid entering trades prematurely or at less favorable positions. This is crucial in pair trading, where the timing of entry and exit significantly influences the risk-reward ratio and overall profitability.

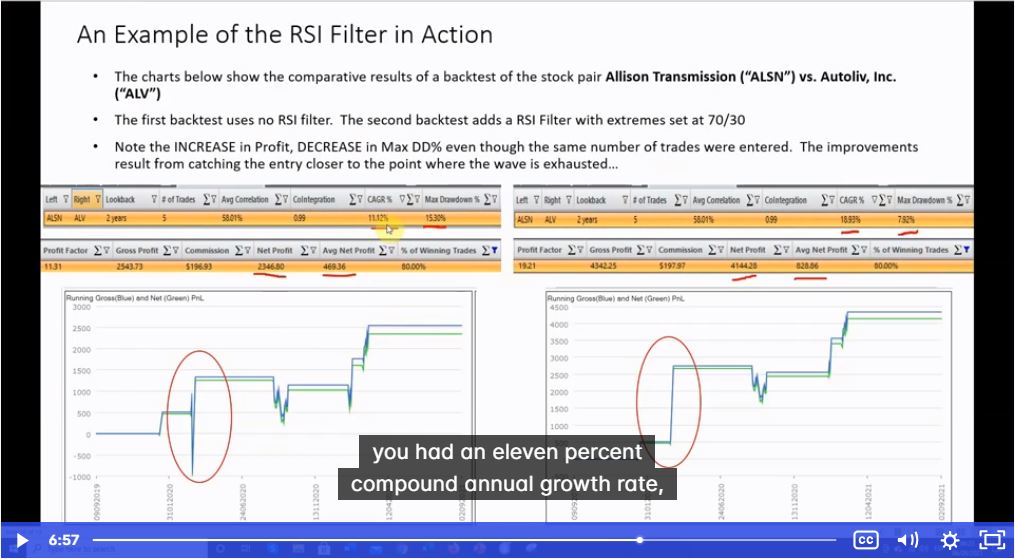

Example of Using an RSI Filter in Pair Trading

An illustrative example within the PTF UA3 is included in our video and can be seen below. It demonstrates how applying the RSI filter to a pair like Allison Transmission versus Autolive can significantly impact outcomes. By adding the RSI filter with extremes set at 70 and 30, traders saw an increase in profit and a decrease in maximum drawdown, even with the same number of trades entered. This strategic approach led to catching entries closer to the point where the price wave is exhausted, thus optimizing the entry point for maximum profit with minimized risk.

RSI Filtering in Pair Trading: Conclusions

In essence, the RSI filter within PairTrade Finder® Ultimate Alpha 3.0 acts as a sophisticated risk management tool, enabling traders to enhance their strategies by entering trades only when the probability of mean reversion is highest. This addition not only aids in maximizing profits and reducing losses but also in improving the psychological comfort of trading, bolstering confidence in one’s trading decisions. For traders committed to the art of pair trading, incorporating the RSI filter into their strategy is not just an option—it’s a necessity for refining their approach and achieving superior results.

For those readers looking to learn pair trading and, most importantly, how to achieve consistent pair trading profitability, we recommend you join PairTrade Finder®’s free Pair Trading 101 webinar.