Most traders intuitively understand that returns mean very little without context. What ultimately matters is how those returns are generated, the drawdowns required to earn them, and whether the strategy survives hostile market environments.

That is precisely why equity market neutral (EMN) trading strategies have been a core allocation for institutional capital for decades—and why they are now becoming accessible to sophisticated retail traders.

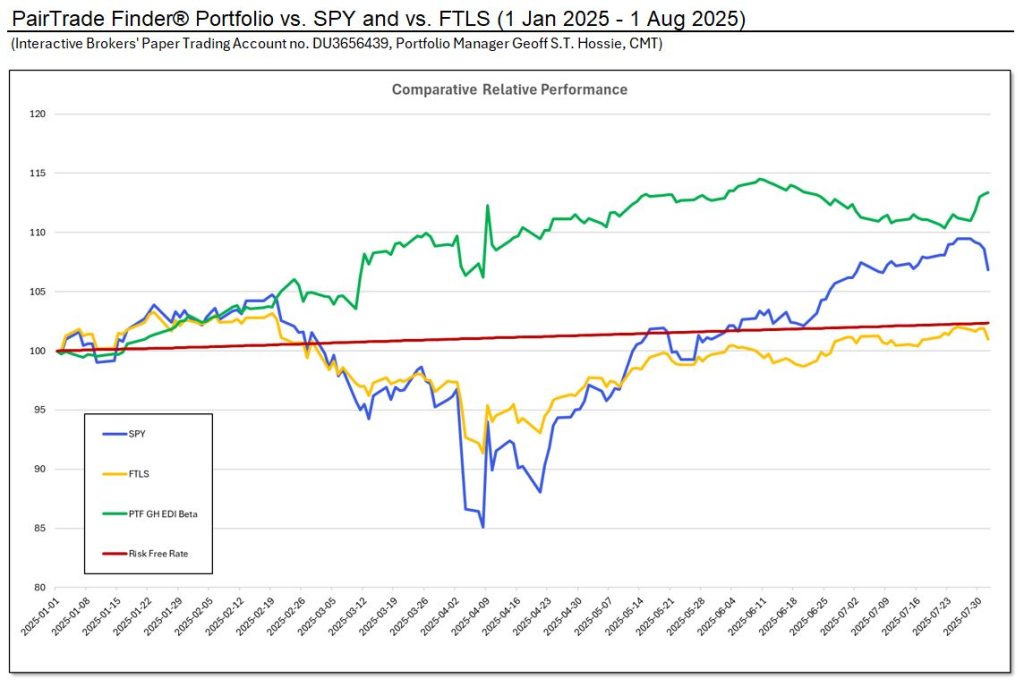

In this post, we’ll walk through a real institutional dataset, compare it directly to the S&P 500, and then run a simple but powerful thought experiment: what happens if a retail trader applies modest leverage—available today at Interactive Brokers—to an institutional EMN return stream?

… Read More →

Trade-Level Performance: Precision in Execution

Trade-Level Performance: Precision in Execution