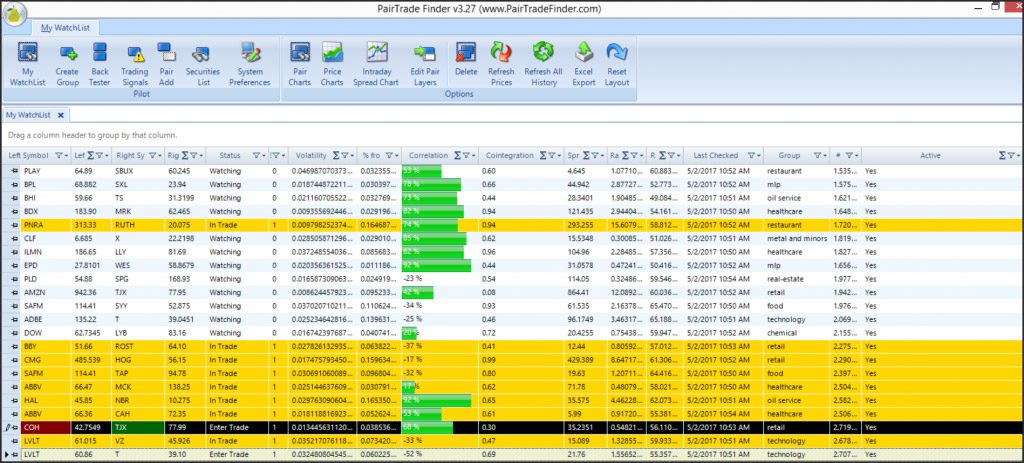

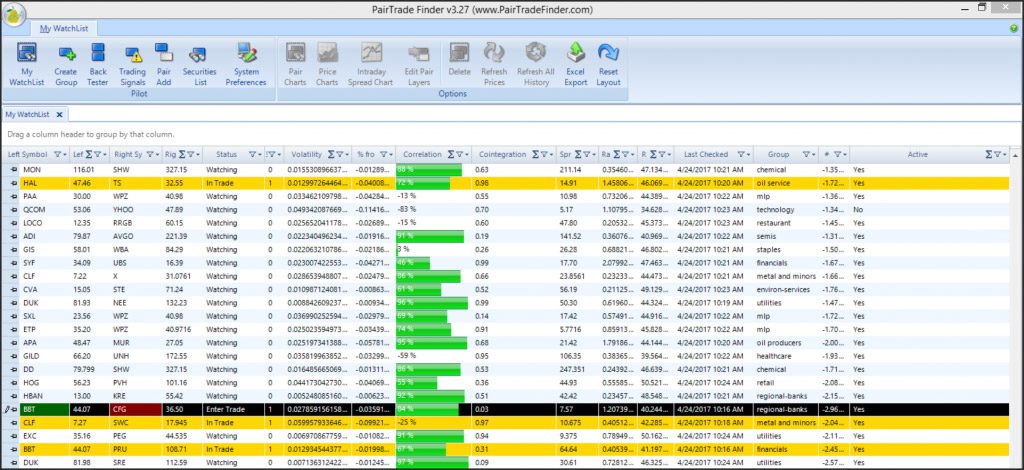

Your watch list will act as your home screen where you can evaluate pairs that have back tested through the Pair Trade Finder system. After you have gone through the process of finding pairs to evaluate, back testing them, and adding them to the system, your pairs will be viewable on your watch list. There are a few important issues you should consider when developing a portfolio of stock pairs to watch, which include the number of specific industry pairs you should monitor, single stock concentration and how to anticipate a signal.

After you have gone through the process of finding companies that are in similar industries,

… Read More →