Don’t want to read? Watch our VIDEO HERE:

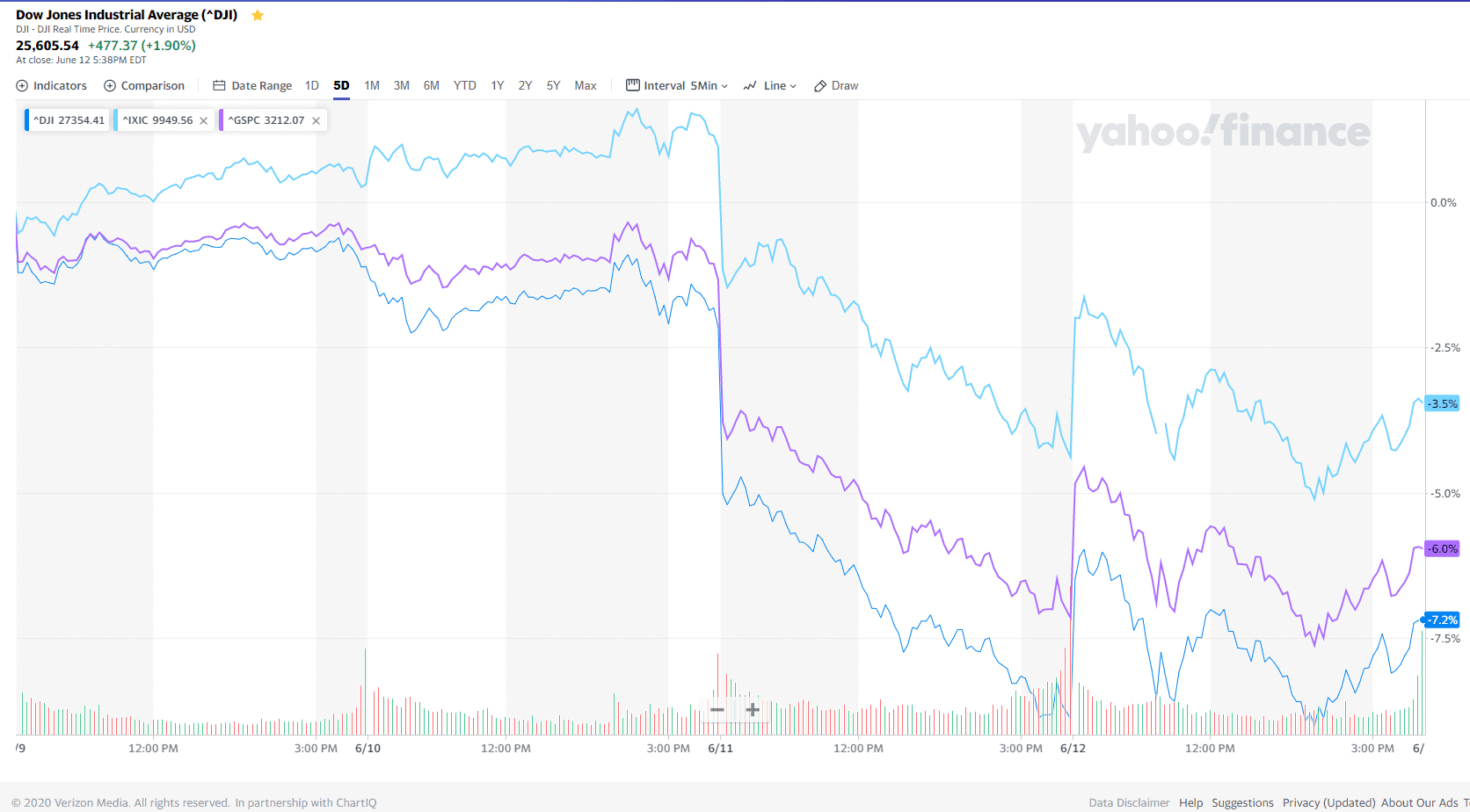

Pair Trading, which you may or may not know, involves simultaneously entering LONG (i.e. BUYING) and entering SHORT (i.e. SELLING) two “paired” securities.

It provides protection from market crashes, controlled risk, low correlation to the market averages and ability to generate significant income and consistent returns.

… Read More →