In the world of trading, where opportunities and pitfalls abound, equities pair trading stands out as a strategy that offers unique advantages. For intermediate-level traders with a solid understanding of trading and basic mathematics, employing the cointegration method in stock pair trading can unlock a world of potential gains. In this article, we delve into the benefits of equities pair trading using the cointegration method and explore the likely expected trading returns based on the latest academic research focused on S&P 500 stocks.

Understanding Equities Pair Trading

Equities pair trading involves selecting two correlated stocks and taking positions based on the historical relationship between their prices. The core idea is to profit from the relative performance between the two assets, rather than the overall market direction. This approach can be particularly appealing in volatile markets, as it allows traders to potentially generate profits irrespective of market conditions.

The Power of Cointegration

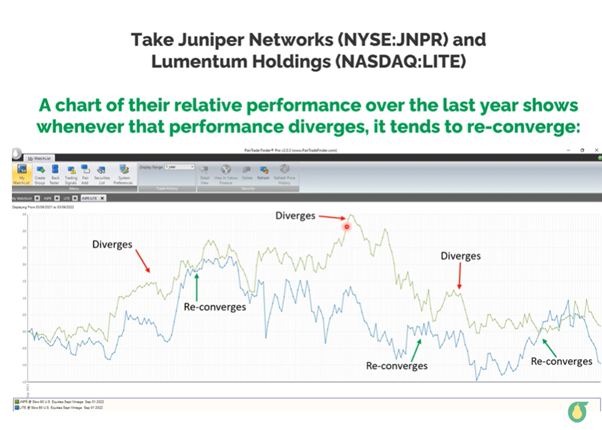

Cointegration, a statistical technique, helps identify long-term equilibrium relationships between two or more securities. By utilizing cointegration in equities pair trading, traders can enhance their ability to predict and capitalize on price divergences and mean-reversion patterns. This means that even if the prices of the two stocks temporarily deviate from their long-term relationship, they are likely to converge over time, presenting lucrative trading opportunities:

Source: The Secret of Cointegration

Expected Returns and Academic Research

Academic research focused on S&P 500 stocks has shed light on the potential returns that equities pair trading using the cointegration method can offer. Recent studies indicate that well-constructed pairs have shown statistically significant and positive returns over various time horizons. By carefully selecting pairs based on robust statistical analysis, traders can improve their chances of achieving consistent profits.

Examples of recent research and their profitability findings on the S&P 500 stock universe using standard pair trading methods and correlation and cointegration for pair selection are as follows:

“Including transaction costs, robust strategies…are the following: Cointegration [pair trading selection method] whatever the length of the formation period or the opening trigger. Returns are especially high with monthly excess returns, including transaction costs, greater that 1.38% and going up to about 5% over a period of more than 10 years. These are clearly the main and most impressive empirical finding of this article.”

Pairs trading and selection methods: is cointegration superior? , Nicolas Huck & Komivi Afawubo, 2015

“We test an equity pairs trading strategy that uses historical return correlations to determine pairs…We find that a trading strategy that bets on this convergence generates… alphas of up to 36% annually for an equal-weighted [unlevered] portfolio.”

Empirical Investigation of an Equity Pairs Trading Strategy, Huafeng Chen, Shaojun Chen, Feng Li, September 2012

Conclusion

Equities pair trading, when combined with the cointegration method, empowers intermediate-level traders to identify and capitalize on market inefficiencies. By leveraging the historical relationship between two stocks, traders can potentially generate profits regardless of the broader market direction. The latest academic research on S&P 500 stocks highlights the potential for positive and statistically significant returns through this trading strategy.

As with any trading approach, it is crucial to conduct thorough research, apply risk management strategies, and continually refine one’s trading methodology. Embracing equities pair trading using the cointegration method can open doors to new opportunities and propel traders towards their financial goals.

For those readers looking to learn pair trading and, most importantly, how to achieve consistent pair trading profitability, we recommend you join PairTrade Finder®’s free Pair Trading 101 webinar.