Tag Archives: Pair Trading Software

Pair Trading Software: A Smart Way to Trade Stocks

EXPLODE Your Profits: How Our FAST 50 U.S Equities Pairs Are Crushing It!

Hey there, rockstar trader,

Did you hear? Our FAST 50 U.S. Equities Pairs live signals are on FIRE! If you’re out of the loop on the FAST 50 magic, stop missing out! Click here to dive into our intro video.

Let’s break it down:

- Launch Date: 19 June 2023

- Total Weeks Trading: 8

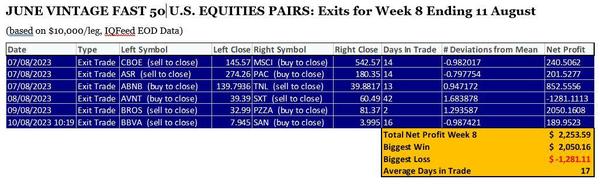

Here’s your golden nugget for the week ending 11 August:

Stock Pair Trading Signals, … Read More →

Stock Pair Trading Signals, … Read More →

Unleashing the Power of Equities Pair Trading: Exploring Cointegration and Expected Returns

In the world of trading, where opportunities and pitfalls abound, equities pair trading stands out as a strategy that offers unique advantages. For intermediate-level traders with a solid understanding of trading and basic mathematics, employing the cointegration method in stock pair trading can unlock a world of potential gains. In this article, we delve into the benefits of equities pair trading using the cointegration method and explore the likely expected trading returns based on the latest academic research focused on S&P 500 stocks.

Understanding Equities Pair TradingEquities pair trading involves selecting two correlated stocks and taking positions based on the historical relationship between their prices.

… Read More →Trade of the Month MAY 2023

Pair Trade Money Management

For any good trading system, money management is a critical component to overlay. We refer to position sizing and trade management as “Money Management”.

April’s Trade of the Month barked and bit – like a badly behaved dog to be fair. However – if you are using prudent pair trade money management techniques – you can force a scary Cerberus back into his cage and turn this losing trade into a winner! Watch as professional pair trader Pedro Alonso takes you through what you need to know in this great VIDEO HERE:

Learn Pair Trade Money Management Techniques Using Our FAST 50 Cointegrated U.S. … Read More →

Learn Pair Trade Money Management Techniques Using Our FAST 50 Cointegrated U.S. … Read More →

Best Stock Pairs to Trade? PTF PRO FAST 50!

Bank stock crashes and crazy market volatility got you down???

Don´t let them! Instead, use the market’s volatility to squeeze profits from stock pair trading! And where do you find the best stock pairs to trade? Look no further than our FAST 50!

Watch our video as professional pair trader Pedro takes you through a killer pair trade on this financial pair in March. Why he loved the trade and the handsome reward/risk profile:

How to Find the Best Stock Pairs to Trade

How to Find the Best Stock Pairs to Trade

When you subscribe to PairTrade Finder® PRO,

… Read More →Automated Pair Trading Signals

(based on 5:1 CFD margin)

Learn a proven trading strategy that is viable in all market conditions and is backed up by decades of academic research and real-world application…stock pair trading! WATCH OUR VIDEO of pro pair trader Pedro Alonso as he takes you through this month’s selected stock pair trade analysis. This live signal is from the automated pair trading signals of our November FAST 50 U.S. Equities Pairs:

Don´t Have Time to Backtest and Filter? … Read More →

Don´t Have Time to Backtest and Filter? … Read More →

Pair Trade of The Month: November 2022

The Best Stock Pairs to Trade www.pairtradefinder.com

Pair Trading for Income?

The Best Stock Pairs to Trade www.pairtradefinder.com

Pair Trading for Income?

Looking for a part-time occupation that can be learned relatively easily and can generate a recurring income?

That can take as little as 1 hour/day or even less?

That uses a share trading system that has been shown to deliver consistent profitability over many decades and in all stock market conditions?

Look no further than stock pair trading with our award-winning software,

… Read More →LIVE Trading Signals MAY FAST 50: 7 Weeks In…

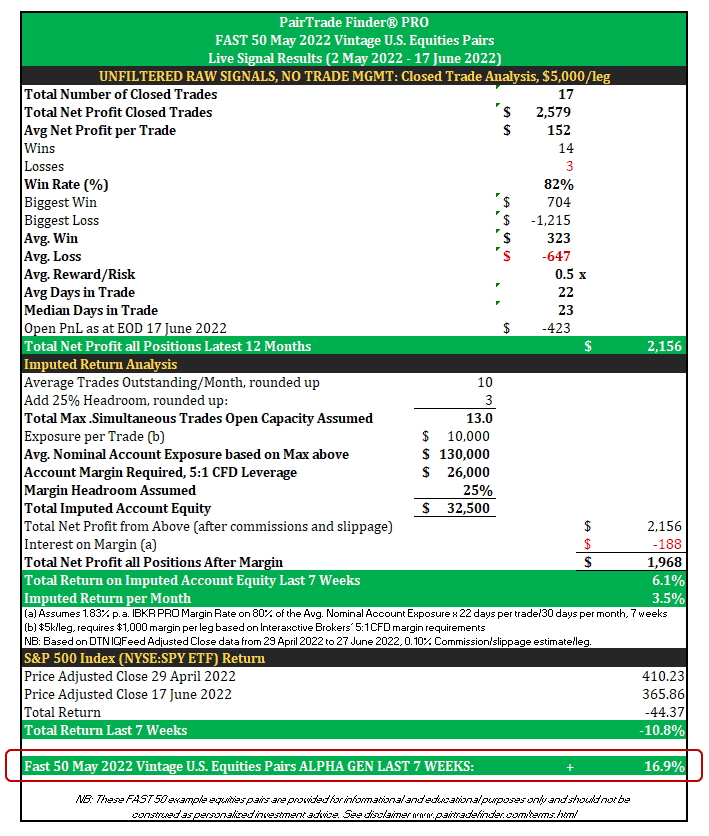

17 closed trades, 14 winners, 82% Win Rate!

The out-of-sample, unfiltered LIVE trading signals generated from our May Vintage FAST 50 U.S.Equities Pairs, which launched on 2 May 2022, delivered approx. $2,000 Net Profit on an imputed account equity of about $30,000 for more than a 6% return. Meanwhile buy & hold of the S&P 500, including dividends, delivered -10.8% over the same period!

Here is a detailed summary of the performance:

Here are the live trading signals as outlined above,

… Read More →“Dog” of the Month May 2022

If you are the type of pair trader that likes to trade raw signals from our FAST 50 U.S. Equities Pairs, then you are probably in a lot of PnL pain this month from EXPE/MAR…

Our message? Don’t be!

Watch our video as pro pair trader Pedro Alonso Calvo takes you through his arsenal of pair trade management techniques. His discipline can help you avoid large PnL losses from a pair trade that begins to perform but then reverses.Also includes a review of the most important filters to respect BEFORE entering any pair trade:

PairTrade Finder®’s FAST 50 U.S. … Read More →

PairTrade Finder®’s FAST 50 U.S. … Read More →