The Best Stock Pairs to Trade www.pairtradefinder.com

Pair Trading for Income?

The Best Stock Pairs to Trade www.pairtradefinder.com

Pair Trading for Income?

Looking for a part-time occupation that can be learned relatively easily and can generate a recurring income?

That can take as little as 1 hour/day or even less?

That uses a share trading system that has been shown to deliver consistent profitability over many decades and in all stock market conditions?

Look no further than stock pair trading with our award-winning software,

… Read More →

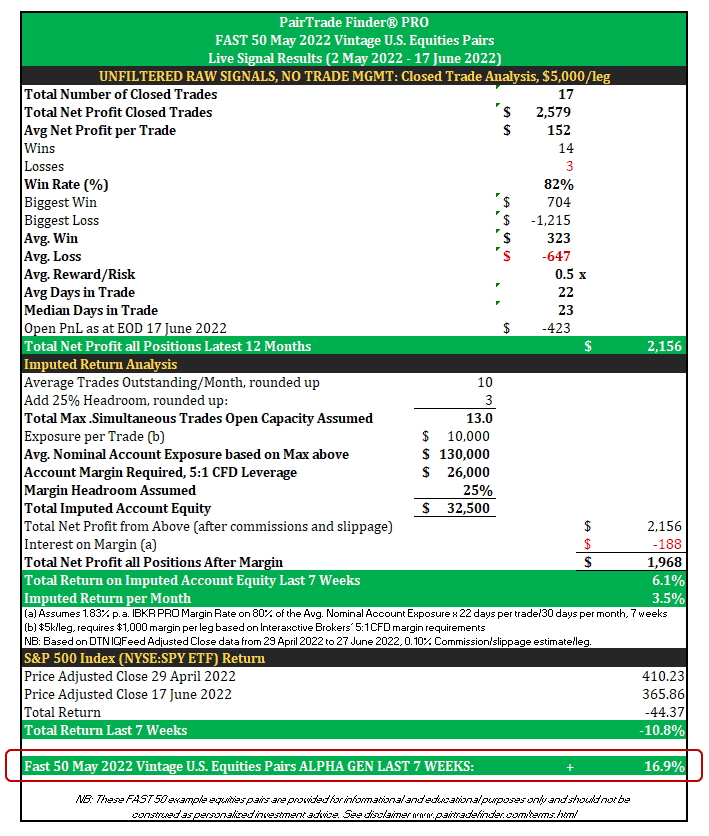

PairTrade Finder®’s FAST 50 U.S.

PairTrade Finder®’s FAST 50 U.S.